Turns out personal finance is about psychology as much as it is about math! How a casual chat forced me to confront some fucked-up thoughts I harbored about money, happiness and the value of a human being.

The Incident

I was in my mother’s kitchen, talking about my obsession: escaping the cubicle to travel the world. Expressing normal motherly concern, she said something along the lines of “what if you run out money?”

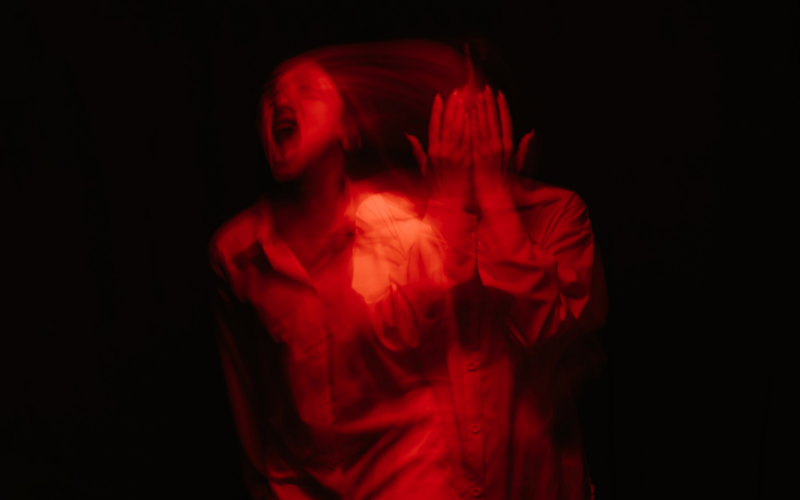

In a stream of consciousness moment while multi-tasking, I blurted out, “I’ll just kill myself if I run out of money.”

The horrified look on my mom’s face was a wake-up call. Her mouth was gaping and eyes glazed over in disbelief. “What? What’d I say?,” I thought to myself. I had assumed my response was logical, even rational. But her reaction made me realize I was fucked.

Reflection

This incident forced me to take a hard look at my money mindset and trace the origins. I realized that my attitude toward money was deeply rooted in my upbringing and societal conditioning.

Unknown, yet somehow familiar voices seemed to whisper in my ear:

- Financial security is paramount.

- Any deviation from the traditional path is reckless and irresponsible.

- Being broke is obviously the consequence of a deep moral failing!

- You should always be worried about money.

- Bankruptcy, a mortal sin!

- Taking a day off…somebody must be sick or dead.

But where did these beliefs even come from? It wasn’t like someone handed me a manual on “How to Think About Money” when I was a kid. There were just subtle queues that I picked up from my parents, (I know, poor parents always get blamed…still love you guys,) family, the cast of characters in my environment. I picked up on the things that were subtly rewarded and what was admonished by society around me.

With these deeply internalized beliefs, I tried to take the conventional path and make sure to always be a hard-worker. I had my first W-2 job at 14, bussing tables at the local steakhouse, and have almost always had 2 jobs since. The idea of having just one income seemed too risky. I went to college, and squirreled away money frenetically in a savings account without any clear purpose.

Evolution

As happens, I grew up, went places, met new people. My thoughts and behaviors started to change. There came a point where, even as risk averse as I was, I felt compelled to do something extremely against my upbringing. I quit the safe, socially admired, professional job I had gone to school for. It was not, however, lucrative nor a good fit for me.

I didn’t really have a plan, family or social support, but I did still have my work ethic. Working two pretty pitiful jobs, eventually I did find my way to a new, better-fitting, and more lucrative career. I was back on track, by social standards, again worthy of approval.

I still wasn’t happy.

That’s when my obsession with escaping my job to travel the world started. I learned everything I could about financial independence and early retirement. My work ethic and natural propensity for savings served me well. Now armed with a good reason for saving, it got even easier!

I learned all about investing, tax efficiency, safe withdrawal rates….you know, all the sexy stuff!

Revelation

However, amidst all this financial enlightenment, my deep-seated beliefs about money and self-worth lingered. Somehow, I was okay with other people not working themselves to the bone, having financial setbacks, appreciated others just for being themselves. But for me, working hard and always being able to pay my way were essential to my sense of self worth. I couldn’t believe that I was deserving of a place on this planet without adding labor or money.

How fucked up is that? Writing it down here to share with you brings tears to my eyes, and a stabbing pain in my heart. I guess, those feelings still resonate with me a little bit. Also, I feel empathy for that previous me. And for anyone else out there who has these thoughts, I feel you, too. You are literally not alone!

At the time, I talked over the incident and my discoveries with my partner and decided the life I was working hard, and saving for, would not be served by this type of thinking. This old belief system had to go.

Resolution

But that is easier said than done. Changing thoughts and behaviors is a slow and tedious process. But I leveraged my work ethic and I threw myself into making a new rubric for success. I found this much harder than working and saving!

I focused on building financial security without allowing it to consume me or define my existence. I challenge my negative self-talk, actively trying to replace them with uplifting affirmations. I’ve set goals for myself that don’t involve money, but rather building other assets like relationships, meaningful experiences and personal growth. You can read about my experience with those efforts in my article, Money Will Not Save You.

I’ve gradually reshaped my money mindset, for a healthier, more balanced perspective on value. This balance has allowed me to pursue my dreams of traveling while also being mindful of my long-term financial well-being. I’m certain that if I had not had this revelation and worked on this emotional part of finance, I would still be sitting in my cubicle, toiling away to build an enormous portfolio of only the safest financial assets.

Sure, my bank balance might not be skyrocketing as it once did. I’ve come to terms with the fact that financial fortunes will ebb and flow. Occasionally, I remind myself that I could very well, despite all my efforts, end up broke some day. I hope that day never comes! But if it does, I’m better equipped to handle it with a mindset that values me as more than just the numbers in a bank account.

Conclusion

I’ve come to understand that finances are not all about math, and that the math is the usually the easy part. What’s difficult is the thoughts, beliefs, assumptions that sometimes lay dormant in our noggins, just waiting to pop up and make trouble. We must work on both the math and psychological aspects to truly be the master of our finances.

I’m grateful for the progress I’ve made in my relationship with money. I couldn’t have reached the point I’m at now without other people. We need people to be mirrors to reflect to us things we cannot see about ourselves, talk over our revelations, give us kindness when we cannot give it to ourselves.

Who do you have to be your mirror? Who do you look to for guidance, share your thoughts with, hold your hand? If you don’t have a community, there is one out there for you, I promise. Don’t despair, even when things seem fucked. And don’t believe everything you think!

Comment below, share your story! I

Live a Life You Love

Tired of feeling stuck? Let’s create your escape plan. Schedule your free session today.

Leave a Reply